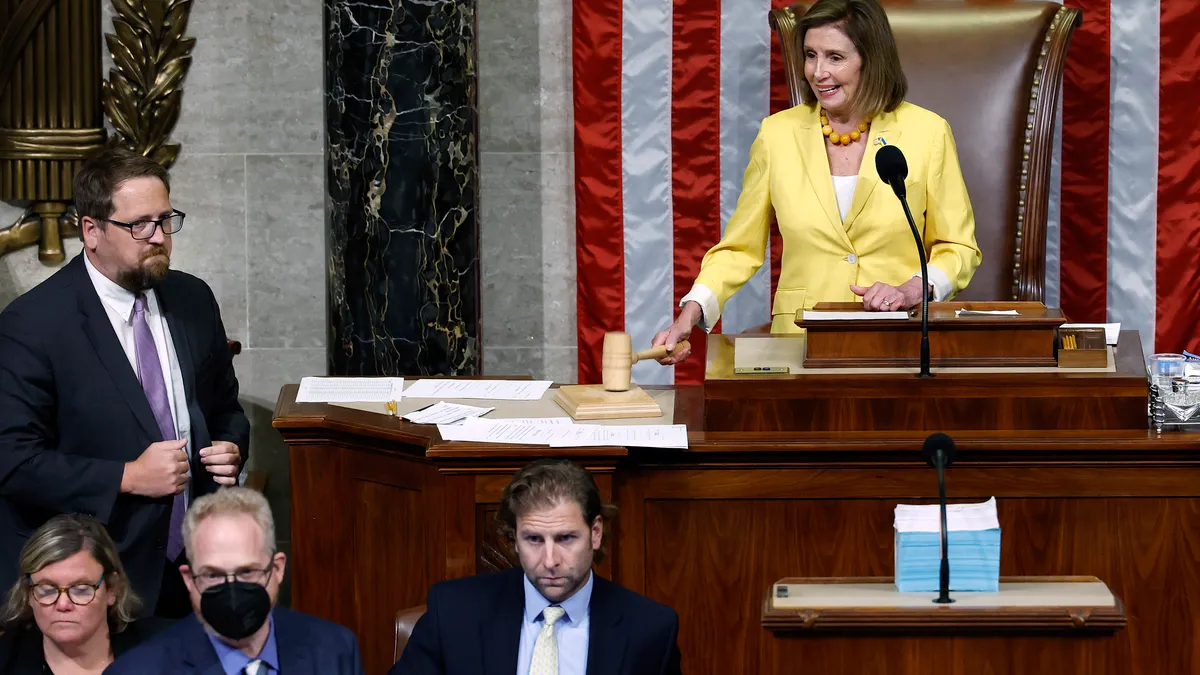

The Inflation Reduction Act, which Democrats and some waste and recycling groups call a “historic” climate change bill, is soon heading to President Joe Biden for a signature. The U.S. House of Representatives passed the bill on Friday 220-207, with all Democrats voting in favor and all Republicans opposed.

Passage of the bill would provide new and expanded tax credits for biogas projects, extend an alternative fuel tax credit and reinstate a tax on some oil companies to fund the U.S. EPA’s Superfund program. It would also establish a 1% excise tax on stock buybacks and a 15% corporate minimum tax that could potentially apply to some of the largest U.S. waste companies.

Biogas industry representatives applauded the bill’s inclusion of biogas provisions.

The American Biogas Council said the bill brings funding stability to the industry that once had to compete with other energy industries, such as wind and solar, that enjoy long-term tax credits. “Before this bill, our industry had only benefited from short one- to two-year extensions of a tax credit that served one sector of the biogas industry,” ABC said in a statement. “For the first time, this bill gives developers and financiers certainty and a competitive edge that will fuel growth of the biogas and clean energy industries for years to come.”

Andrew Benedek, chairman and CEO of organics recycler and RNG producer Anaergia, said in a statement that the bill will directly benefit the construction of biogas facilities in the U.S. He specifically highlighted the provision expanding Section 48 energy investment tax credits on biogas operations that begin construction before 2025, as well as the extended alternative fuel tax credit and updates to credit rates for the 45Q carbon sequestration tax credit.

“The Inflation Reduction Act will do more to reduce greenhouse gas emissions in the United States than any other legislation in this nation’s history,” he said in a statement.

The National Waste & Recycling Association has voiced strong opposition to the bill’s tax structure, especially the 15% corporate tax meant to fund most of the bill, because the organization says it will hurt businesses.

Environmentalists applauded the bill’s inclusion of a reinstated “polluter pays” excise tax on oil and petroleum companies, a tax that once funded the U.S. EPA’s Superfund program when that program was established in 1980. That tax lapsed in 1995, leaving taxpayers to fund the program, according to Rep. Frank Pallone, D-N.J., who sponsored the Superfund Polluter Pays Act included in the House version of the IRA. The reinstated tax would direct about $11.7 billion to the program, with the tax going into effect Jan. 1, 2023.

Emily Rogers, a Zero Out Toxics program advocate with USPIRG, said the EPA’s Superfund program has struggled with funding issues for years, and a fully-funded program will become even more important as the country experiences larger “climate-induced” storms such as hurricanes, which could flood Superfund sites and leak contamination, she said in a statement.

A boost to Superfund cleanup activity could be beneficial for some waste companies that see such projects as a potential business opportunity.

Overall, the Inflation Reduction Act would spend about $369 billion on energy and climate projects in the next 10 years.